Unit contribution margin calculator

Unit contribution margin per unit denotes the profit potential of a product or activity from the. We can represent contribution margin in percentage as well.

Contribution Margin Meaning Formula How To Calculate

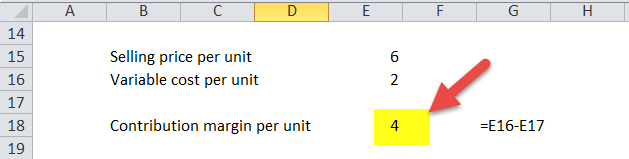

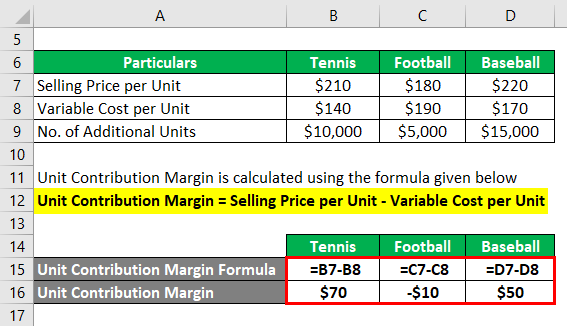

The variable cost per unit is 2 per unit.

. Margin and Markup Calculator. Gross margin is not commonly used for service businesses as cost of goods is not a major consideration. Margin and Markup Calculator.

The company has net sales of 300000. Contribution Margin Per Unit Per Unit Selling Price Per Unit Variable Cost. Latham Watkins a global law firm advises the businesses and institutions that power the global economy.

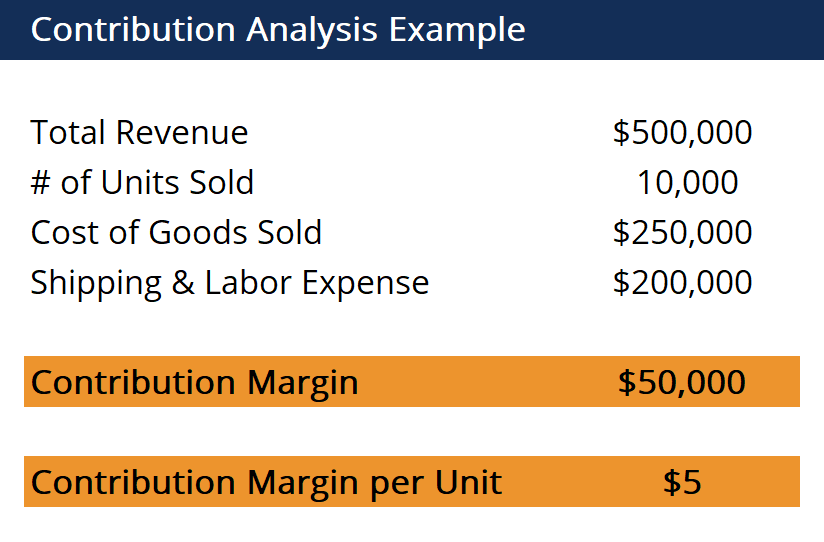

The contribution margin is calculated by deducting all costs from sales revenue except those associated with production. The contribution margin is 6000 - 1000 5000. Calculate Net Distribution Gross Distribution Gross Amount.

The other possible weight that a freight company may use to calculate shipping costs is called cubic weight and that is based on cubic feetmeters. CPP canada pension plan contribution calculator 2021. This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm.

But this same café also sells muffins. The Contribution Margin Calculator is an online tool that allows you to calculate contribution margin. TFSA contribution maximum for 2022 and earlier Employment insurance.

This online sales tax calculator solves multiple problems around the tax imposed on the sale of goods and services. 401k Save the Max Calculator. Gross profit margins are always displayed as a percentage figure never whole numbers.

A contribution margin is a measure of contribution to the overall profit. You can use the following Calculator. This distance calculator is designed for organisations taking part in the Erasmus Programme to calculate travel distances for grant.

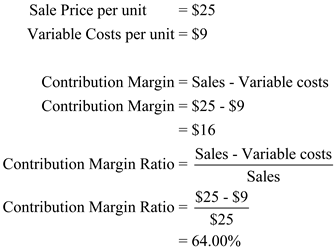

Employment insurance benefits in Canada for 2022. Federal Withholdings State. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio.

The Revenue from all muffins sold in March is 6000. Next calculate the gross sales by multiplying the number of units sold step 1 and the sales price per unit step 2 as shown below. That sounds like a good result.

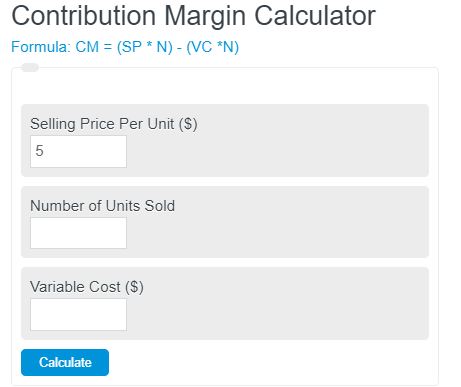

These amounts are dependent on various factors including administrative costs incurred by participating organisations and the National Agencies. By comparing a companys current annual financial performance to that of 12 months back the rate at which the company has grown as well as any cyclical patterns can be. Now lets try to understand the contribution margin per unit with the help of an example.

Next determine the sales price per unit of the product. Loan Calculator Required field. This tool is not designed for individuals to determine how much they should receive in funding.

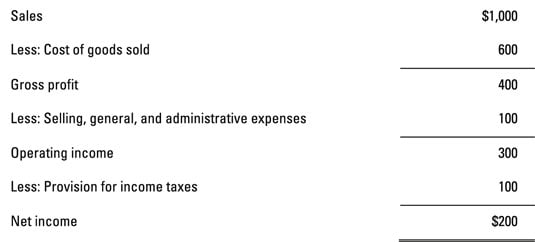

Gross profit margin Gross profit Total revenue 100. What is YoY Growth. Variable costs total 1000.

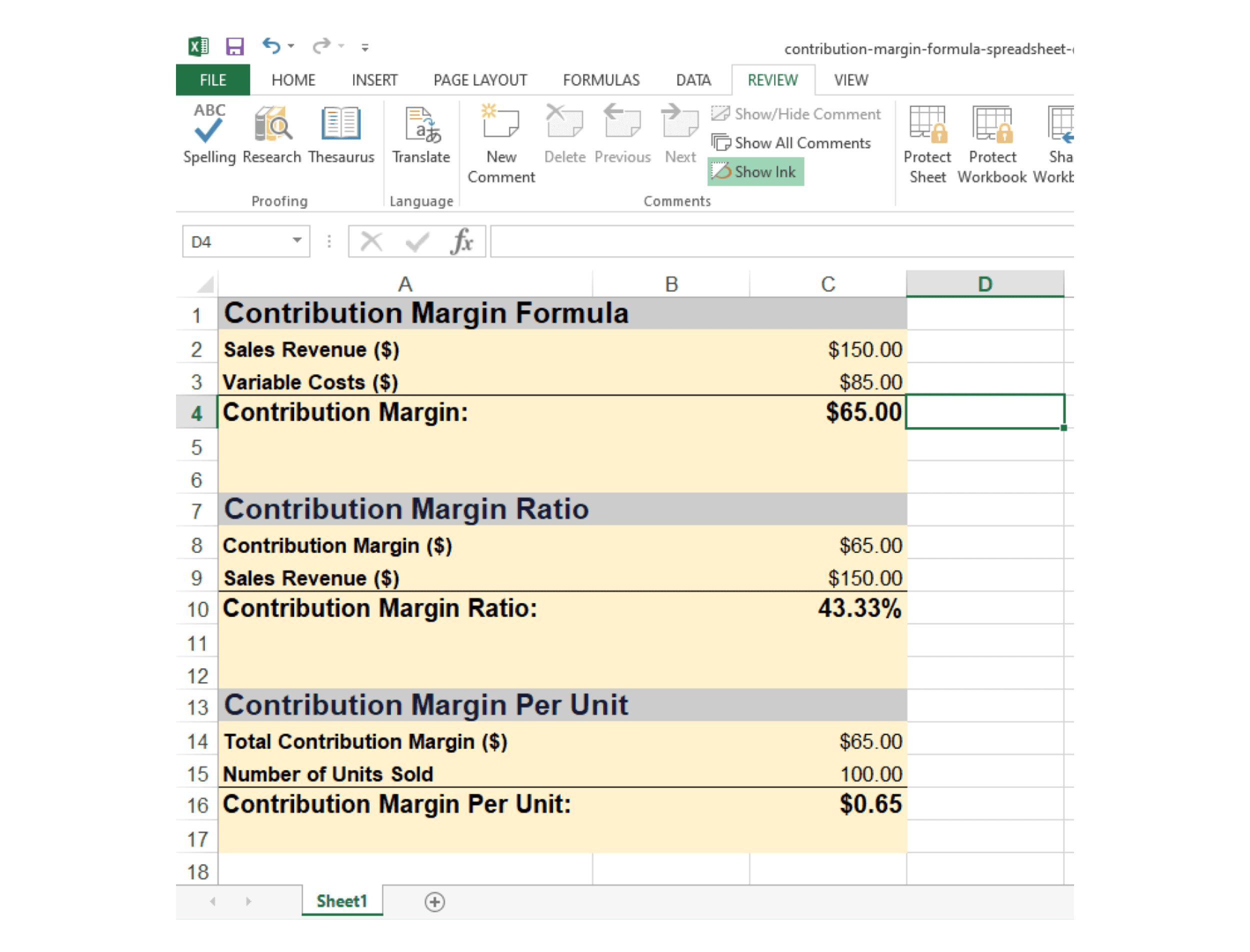

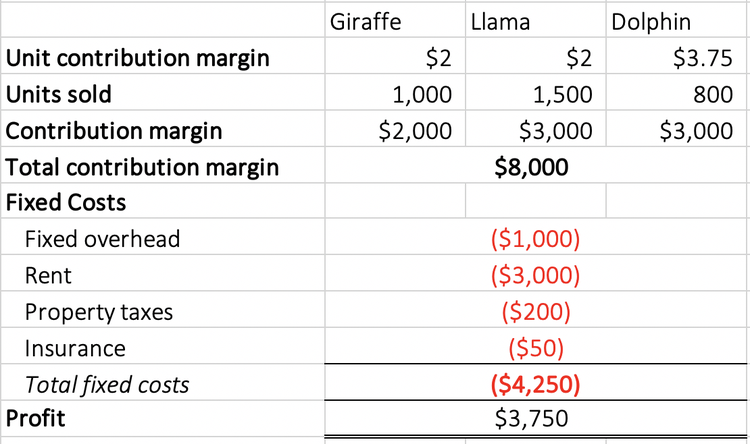

Absorption Costing Both Marginal Costing and Absorption Costing are two different approaches used to evaluate inventory. The contribution margin ratio shows a margin of 60 600010000. Freight transportation companies charge one of two rates for shipping.

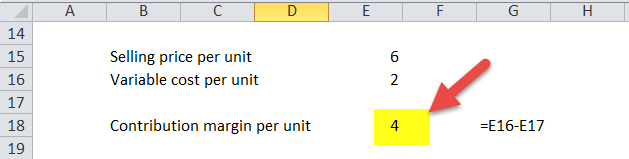

The number of units sold was 50000 units. RRSP contribution limit for 2021 2020 revenus. You can use the contribution margin calculator using either.

Find out the contribution contribution margin per unit and contribution ratio. The first is called dead weight. We leverage our vast global resources to work relentlessly and efficiently to accomplish client goals.

US Paycheck Tax Calculator. In the case of marginal costing only variable cost incurred by the company is applied to the inventory. That is the actual weight of the item to be shipped in its completely boxed and ready-to-ship form.

RRSP contribution limit for 2022 2021 revenus. This 4-20 mA calculator is used to calculate the original measurement of overall vibration or other physical pressure units as determined by the user or type of transducer using the output current of the 4-20 mA transducer as well as the minimum and maximum of the unit range for the device. Absorption Costing Marginal Costing Vs.

401k Save the Max Calculator. Loan Amount Interest Rate per. CPP canada pension plan contribution calculator 2022.

Gross Sales Total Units Sold Sales Price Per Unit. Gross profit per unit can also be called contribution margin. The contribution margin ratio shows a margin of 83 50006000.

The contribution margin can be calculated based on total sales including all expenses or it can be calculated based on sales after certain expenses. Year-over-Year YoY Growth measures the change in an annualized metric across two comparable periods typically the current period and the prior period as of the fiscal year-end date. It can calculate the gross price based on the net price and the tax rate or work the other way around as a reverse sales tax calculatorThe sales tax system in the United States is somewhat complicated as the rate is different depending on the state and.

Contribution Margin Formula And Ratio Calculator

Contribution Margin Ratio Template Download Free Excel Template

Contribution Margin Calculator Calculator Academy

Unit Contribution Margin How To Calculate Unit Contribution Margin

Contribution Margin Formula And Ratio Calculator

Contribution Margin Formula And Ratio Calculator

Contribution Margin Ratio Revenue After Variable Costs

Contribution Analysis Formula Example How To Calculate

Contribution Margin Ratio Formula Per Unit Example Calculation

Unit Contribution Margin How To Calculate Unit Contribution Margin

Contribution Margin What It Is And How To Calculate It

Weighted Average Unit Contribution Margin Double Entry Bookkeeping

Breakeven Units Using Weighted Average Contribution Margin Youtube

Solved Chapter 6 Problem 9e Solution Managerial Accounting 3rd Edition Chegg Com

How To Compute Contribution Margin Dummies

How To Calculate The Unit Contribution Margin

Contribution Margin Formula With Calculator